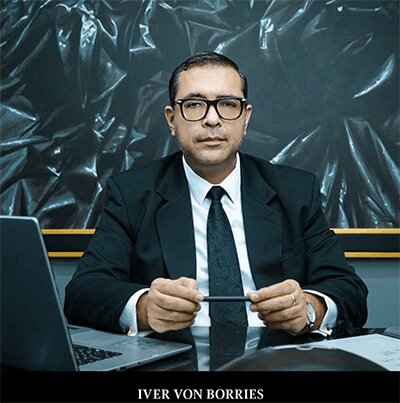

Renowned corporate lawyers Iver von Borries and Javier Romero Mendizábal have submitted a draft bill to the Senate aimed at addressing the issue of maintaining the value of the Bolivian currency. This initiative seeks to amend Law 2434 by explicitly recognizing Tether (USDT), a stablecoin currently listed on the Central Bank of Bolivia’s electronic board, for use in indexing contracts and financial transactions in Bolivia.

ISSUE 137 | 2024

Vesna Marinkovic U.

1How did the initiative to present a draft bill to the Senate, aimed at solving the issue of maintaining the value of the Bolivian currency in the current economic context, come about?

IVB: La iniciativa surge a partir de la situación económica actual de Bolivia, caracterizada por la incertidumbre en el tipo de cambio y la devaluación del boliviano. Grandes sumas de dinero, tanto de fondos públicos como privados, no se están asignando ni contratando debido a la volatilidad y falta de confianza en el tipo de cambio oficial. Esto genera inseguridad para los oferentes y contratistas. El proyecto de ley busca adaptar la normativa existente a las nuevas realidades económicas y financieras al reconocer a Tether (USDT) como una criptomoneda estable para la indexación de contratos, lo que ayudaría a preservar el valor de las transacciones y brindaría mayor estabilidad a las relaciones. económico en el país.

2En este contexto, ¿será difícil modificar la Ley 2434 para reconocer a Tether (USDT) como un índice válido y confiable para actualizar valores en contratos civiles y comerciales en el país?

JRM: Todo depende de la voluntad política que haya en la Asamblea Legislativa Plurinacional. El proyecto apunta precisamente a reconocer explícitamente a Tether (USDT) como una criptomoneda estable para ser utilizada en la indexación de contratos y restablecer el equilibrio perdido hasta la fecha. La modificación está pensada para adaptarse a las realidades tecnológicas y financieras actuales. Además, el proyecto cuenta con el apoyo de destacados economistas bolivianos y del Colegio de Abogados de Santa Cruz, lo que podría facilitar su tramitación.

3De lograrse esta modificación a la normativa boliviana, ¿Tether sería utilizado en transacciones entre particulares, empresas y entidades públicas?

IVB: Sí, de aprobarse la modificación, Tether (USDT) podría ser utilizado válidamente en transacciones entre particulares, empresas y entidades públicas para la indexación de contratos. Esto permitiría a las partes utilizar USDT como índice de referencia para la actualización de montos y valores en contratos civiles y comerciales, facilitando las transacciones y contratos en un contexto económico incierto.

“Everything depends on the political will in the Plurinational Legislative Assembly. The project aims precisely to explicitly recognize Tether (USDT) as a stable cryptocurrency…”

4Could this measure provide legal and contractual stability among the country’s economic actors?

JRM: Indeed, the measure could provide greater legal and contractual stability. By allowing the use of Tether (USDT) as a valid index for value updating, the parties to a contract would have a more reliable and stable mechanism to adjust agreed amounts, reducing uncertainty about inflation and the devaluation of the Bolivian currency. This would create a safer environment for negotiations and transactions, both between private individuals and between public and private companies.

5If this bill becomes a reality, could Bolivia position itself globally in the financial and technological fields?

IVB: We believe so; if this bill is passed, Bolivia could position itself as a leader in the use of emerging financial technologies such as cryptocurrencies and blockchain. Recognizing Tether (USDT) as a valid index in contracts could attract investment and increase trust in the Bolivian financial system, while paving the way for the development of new, more modern contractual and financial practices aligned with global trends in fintech and blockchain.

6What would be the necessary steps and time required to have this regulation in place?

JRM: The necessary steps to have this regulation would include the process of socialization with business and economic entities, the debate and analysis of the relevant committees in the ALP (Plurinational Legislative Assembly), and finally, the approval and promulgation of the amending law by the Plurinational Legislative Assembly. The project has already been submitted to Senator Erick Morón, an economist by profession, who has committed to socializing it. The time required to have this regulation in place will depend on how quickly the aforementioned steps are processed and approved.