Improving institutional capacity, reinforcing macroeconomic and financial stability, and updating hydrocarbon regulations are some of the aspects for structural changes in Bolivia.

ISSUE 120 | 2023

Vesna Marinkovic U.

In an environment heavily marked by uncertainty, the 2023 ECONOMIC FORUM, organized annually by CAINCO, emphasized that the currency crisis that Bolivia is facing is just the first symptom of the structural problems threatening the future trajectory of the national economy.

The president of the institution, Jean Pierre Antelo, highlighted the need for a clear strategy to address the underlying issues affecting the Bolivian economy. He highlighted that this strategy should consider institutional aspects, macroeconomic and financial stability fundamentals, less restrictive and ineffective regulations, and a strong emphasis on productivity, innovation, and development in the 21st century. He asserted that without structural changes, any attempt would only be a palliative for a few years, as seen in the painful Argentine experience.

The 2023 ECONOMIC FORUM made it clear that bolstering the need for a better State is urgent. The low level of institutionalism of state institutions has led to increased bureaucracy and an unfavorable environment for entrepreneurship and its growth.

STRUCTURAL REASONS

According to the participants of the event, particularly the panelists on the hydrocarbon and mining sector, which included Carlos Delius, Héctor Córdova, and Juan Fernando Subirana, one of the structural reasons for this crisis is precisely the decline of the hydrocarbon sector and its effects on public finances and foreign currency reserves.

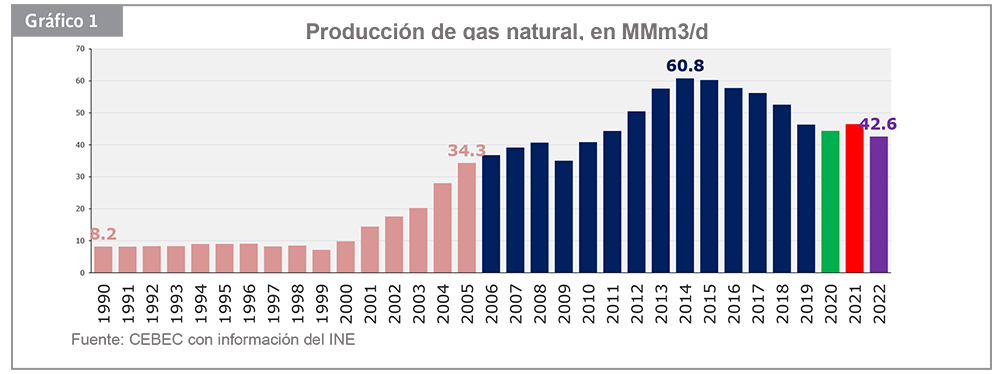

They pointed out that hydrocarbon production has fallen by almost a third since the mid-2000s due to an “unfriendly” regulatory framework for investment in the sector and the lack of corporate governance in related state-owned enterprises. This has resulted in a decrease in fiscal and external revenues, as well as a reduced production of liquids for fuel processing, as shown in Graph 1.

On the other hand, Juan Fernando Subirana, a lecturer at UPSA university and hydrocarbon consultant, mentioned that, under appropriate conditions, the sector would be favorable, but in the current circumstances, it lacks good prospects, mainly due to existing regulations that have been designed “to reap the harvest but not to motivate new plantings.”

“The conditions are not encouraging to continuing with an exploratory cycle,” he said, emphasizing that currently “the country is focused on gas production, making use of what is available.” He added that the sector is only producing gas and is far from engaging in exploratory activities that guarantee new reserves to ensure stability for domestic and foreign markets.

“The reality in the hydrocarbon sector is quite complex,” he said, adding that for Bolivia, in particular, the chance of failure is around 80%, not only because of the regulatory framework but also to the geological characteristics of the hydrocarbon structures, which require deep wells and, for that, investments of around 100 million dollars. At the moment, such investments are difficult to find due to global conditions that are restricting fossil fuel investment.

AVOIDING ANALOGIES WITH LITHIUM

Carlos Delius, former president of the Bolivian Chamber of Hydrocarbons and Energy (CBHE), emphasized the importance of not drawing analogies between gas and lithium in terms of generating economic resources for the State. He asserted that the gas business took more than 20 years to be consolidated.

“I believe it is absolutely essential not to draw analogies between the lithium business and our experience in exploiting Bolivian natural gas. In Bolivia, we have lived on gas in recent decades, and no one can deny that. However, lithium does not have the potential to generate the same revenue for the State as gas did. That is not going to happen again,” Delius emphasized.

He added that what needs to be learned from the gas sector is the lesson of how it was managed to structure it into a world-class business with market security, investment, and appropriate regulatory conditions, which took more than 20 years to build the best business Bolivia ever had.

INCREASING FUEL IMPORTS

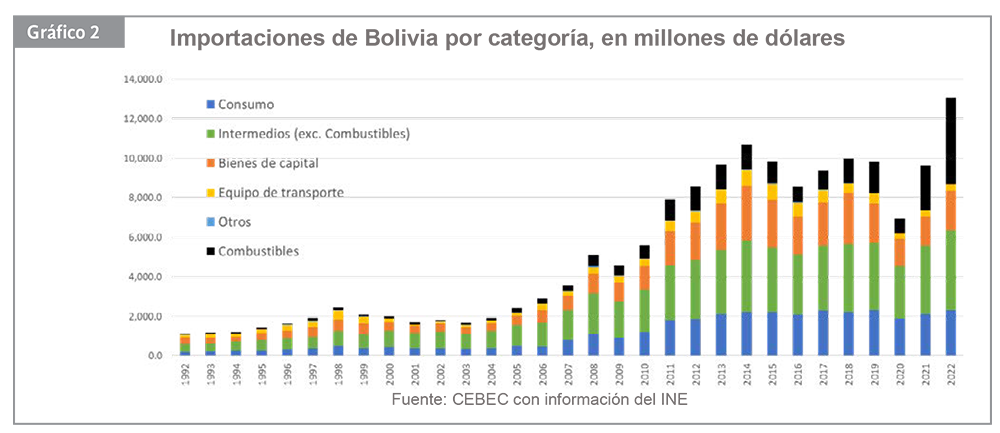

The 2023 ECONOMIC FORUM also emphasized the growing importation of fuels, which reached a total of USD 4 billion in 2022, of which a quarter would correspond to smuggling to other countries (see Table 2).

It also highlighted the importance of reducing the smuggling of fuel out of the country, noting that since 2004 the country has been subsidizing domestic fuel prices, a subsidy that has not been modified since then. This low fuel price has created incentives for smuggling cheap fuel to other countries and make a profit.

According to the event, the comparison between import and domestic consumption figures indicates that around USD 900 million of the USD 4 billion did not enter the country, and it highlights that “a frontal fight against this scourge would reduce the bleeding of foreign exchange reserves in the country.”

I believe it is absolutely essential not to draw analogies between the lithium business and our experience in exploiting Bolivian natural gas.”

The participants were conclusive and unanimous in pointing out that if “correct decisions” are made in the non-renewable extractive sectors of hydrocarbons, mining, and lithium, they can provide the country with stability in the medium term.

“An important warning: all these sectors can contribute to overcoming the crisis, as long as the authorities and political leaders allow it. Without sincere political will focused on the country, these will only be missed opportunities, and we had many of them in our past and recent history. We need changes in public policies reflected in specific regulations to activate these sectors as resource providers,” stated the key sections of the conclusion document of the forum.

It highlights that, in the medium term, the extractive sectors of hydrocarbons, mining, and lithium require a legal framework that can properly combine national sovereignty with attracting Foreign Direct Investment (FDI). It emphasized that the setback in the hydrocarbon sector and the stagnation of mining are clear indications that the current regulations are not promoting sustainable extraction of non-renewable resources.